In this article we will discuss about the accounting treatment for disposal of capital reduction account, explained with the help of a suitable illustration.

The Capital Reduction Account is a temporary account opened in order to carry out the internal reconstruction. When the scheme is carried out, the account is closed. The Capital Reduction Account represents the sacrifice made by the Shareholders, Debenture-holders, Creditors etc.

This sacrificed amount is credited to this account. The appreciation in the value of assets is also credited to this account. This amount available is used to write off accumulated losses, intangible assets, over-valuation of assets, etc. If there is any balance in this account, it will be transferred to Capital Reserve Account.

The various journal entries are as follows:

ADVERTISEMENTS:

ADVERTISEMENTS:

Illustration:

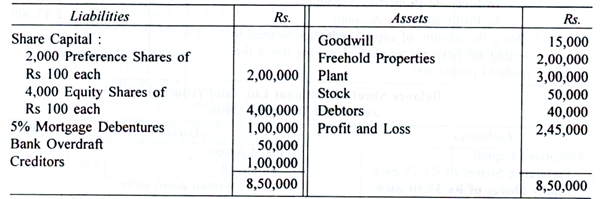

The Balance Sheet of National Ltd. at 31st December, 2006 was as follows:

The company got the following scheme of reconstruction approved by the court:

ADVERTISEMENTS:

1. The preference shares to be reduced to Rs 75 per share, fully paid.

2. The equity shares to be reduced by Rs 63.50 per share.

3. The debenture-holders took over the stock and book debts in full satisfaction of the amount due to them.

4. The Goodwill Account to be eliminated.

ADVERTISEMENTS:

5. The freehold properties to be depreciated by 50%.

6. The value of plant to be increased by Rs 50,000.

7. The Profit and Loss to be eliminated.

Give journal entries for the above and prepare the revised Balance Sheet.

ADVERTISEMENTS:

Solution: