The following points highlight the five main types of ratio analysis. The types are: 1. Profitability Ratios 2. Coverage Ratios 3. Turnover Ratios 4. Financial Ratios 5. Control Ratios.

Ratio Analysis: Type # 1. Profitability Ratios:

Profitability ratios are of utmost importance for a concern. These ratios are calculated to enlighten the end results of business activities which is the sole criterion of the overall efficiency of a business concern.

Following are the important profitability ratios:

(i) Gross Profit Ratio:

ADVERTISEMENTS:

This ratio tells gross margin on trading and is calculated as under:

Higher the ratio, the better it is. A low ratio indicates unfavorable trends in the form of reduction in selling prices not accompanied by proportionate decrease in cost of goods or increase in cost of production. The gross profit should be adequate to cover fixed expenses, dividends and building up of reserves.

In many industries there is more or less recognised gross profit ratio and an analysis of this ratio will indicate whether the ratio of the firm being analysed is satisfactory or not. Gross profit ratio of a firm may be compared with that of competitors in the industry to assess is operational performance in comparison to other players in the industry.

ADVERTISEMENTS:

(ii) Operating Ratio:

This ratio indicates the proportion that the cost of sales bears to sales. Cost of sales includes direct cost of goods sold as well as other operating expenses, administration, selling and distribution expenses which have matching relationship with sales.

It excludes income and expenses which have no bearing on production and sales, i.e., non-operating incomes and expenses as interest and dividend received on investment, interest paid on long-term loans and debentures, profit or loss on sale of fixed assets or long-term investments.

It is calculated as follows:

Lower the ratio, the better it is. Higher the ratio, the less favourable it is because it would have a smaller margin of operating profit for the payment of dividends and the creation of reserves. This ratio should be analysed further to throw light on levels of efficiency prevailing in different elements of total cost.

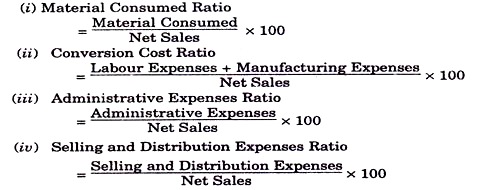

(iii) Expenses Ratios:

These are calculated to ascertain the relationship that exists between operating expenses and volume of sales. Following ratios will help in analysing operating ratio:

(iv) Operating Profit Ratio:

ADVERTISEMENTS:

This ratio establishes the relationship between operating profit and sales and is calculated as follows:

Where

ADVERTISEMENTS:

Operating Profit = Net Profit + Non-operating Expenses − Non-operating Income

Or = Gross Profit − Operating expenses

Or = Net profit before interest and tax.

Operating profit ratio can also be calculated with the help of operating ratio as follows: Operating Profit Ratio = 100 − Operating Ratio.

ADVERTISEMENTS:

This ratio indicates the portion remaining out of every rupee worth of sales after all operating costs and expenses have been met. Higher the ratio the better it is.

(v) Net Profit Ratio:

This ratio is very useful to the proprietors and prospective investors because it reveals the overall profitability of the concern.

ADVERTISEMENTS:

This is the ratio of net profit after taxes to net sales and is calculated as follows:

The ratio differs from the operating profit ratio in as much as it is calculated after deducting non operating expenses, such as loss on sale of fixed assets etc., from operating profit and adding non-operating income like interest or dividends on investments, profit on sale of investments or fixed assets, etc., to such profit. Higher the ratio, the better it is because it gives idea of improved efficiency of the concern.

(vi) Return on Capital Employed or Return on Investment (Overall Profitability Ratio):

It has already been discussed.

(vii) Return on Shareholders’ Fund:

When it is desired to work out the profitability of the company from the shareholders point of view, then it is calculated by the following formula:

The ratio of net profit to shareholders funds shows the extent to which profitability objective is being achieved. Higher the ratio, the better it is.

(viii) Return on Equity Shareholders’ Fund or Return on Net Worth:

This ratio is a measure of the percentage of net profit to equity shareholders’ funds. The ratio is expressed as follows:

Here,

Equity Shareholders’ Fund = Equity Share Capital + Capital Reserves + Revenue Reserves

+ Balance of Profit and Loss Account − Fictitious Assets − Non-business Assets

(ix) Return on Total Assets:

This ratio is calculated to measure the profit after tax against the amount invested in total assets to ascertain whether assets are being utilized properly or not. It is calculated as under:

Suppose net profit after tax is Rs.20,000 and total assets are Rs.1,00,000. Return on total assets will be 20% [i.e., Rs.20,000 ÷ Rs.1,00,000 x 100]. The higher the ratio, the better it is for the concern.

(x) Earnings per Share:

This helps in determining the market price of equity shares of the company and in estimating the company’s capacity to pay dividend to its equity shareholders.

It is calculated as follows:

If there are both preference and equity share capitals, then out of net income first of all preference dividends should be deducted in order to find out the net income available for equity shareholders. The performance and prospects of the company are affected by earning per share.

If earning per share increases, there is a possibility that the company may pay more dividend or issue bonus shares. In short the market price of the share of a company will be affected by all these factors. A comparison of earning per share of the company with another company will also help in deciding whether the equity capital is being effectively used or not.

Though the earning per share is the most widely published data, yet it should be used cautiously as earning per share cannot represent the various financial operations of the business. Moreover, the financial data collected in respect of different companies may be affected by different practices followed by the companies relating to stock in trade, depreciation etc.

This ultimately will affect the calculation of earnings per share and that is why earning per share should be used with precaution while comparing the performance and prospects of two companies.

(xi) Payout Ratio:

This is determined as follows:

Complementary of this ratio is retained Earnings Ratio.

It is calculated as follows:

This ratio indicates as to what proportion of earning per share has been used for paying dividend and what has been retained for ploughing back.

This ratio is very important from shareholders’ point of view as it tells him that if a company has used whole or substantially the whole of it’s earning for paying dividend and retained nothing for future growth and expansion purposes, then there will be very dim chances of capital appreciation in the price of shares of such company.

In other words, an investor who is more interested in capital appreciation must look for a company having low payout ratio.

Ratio Analysis: Type # 2. Coverage Ratios:

These ratios indicate the extent to which the interests of the persons entitled to get a fixed return (i.e. interest or dividend) or a scheduled repayment as per agreed terms are safe. The higher the cover, the better it is.

Under this category the following ratios are calculated:

(i) Fixed Interest Cover:

It really measures the ability of the concern to service the debt. This ratio is very important from lender’s point of view and indicates whether the business would earn sufficient profits to pay periodically the interest charges.

It is calculated as under:

For example if the net profit before interest and tax is Rs.32,000 and interest charges are Rs.4,000 then fixed interest cover will be 8 times (i.e., 32,000 ÷ 4,000). The higher the ratio, the more secured the lenders will be in respect of their periodical interest income.

(ii) Fixed Dividend Cover:

This ratio is important for preference shareholders entitled to get dividend at a fixed rate in priority to other shareholders. It is calculated as follows:

For example, if the profits after interest and tax are Rs.2,70,000 and dividend on preference shares is Rs.27,000, the fixed dividend cover will be 10 times (i.e., Rs.2,70,000 ÷ Rs.27,000).

Ratio Analysis: Type # 3. Turnover Ratios:

These ratios are very important for a concern to judge how well facilities at the disposal of the concern are being used or to measure the effectiveness with which a concern uses its resources at its disposal. In short, these will indicate position of assets usage. These ratios are usually calculated on the basis of sales or cost of sales and are expressed in number of times rather than as a percentage.

Such ratios should be calculated separately for each type of asset. The greater the ratio more will be efficiency of asset usage. The lower ratio will reflect the under utilisation of the resources available at the command of the concern. The concern must always plan for efficient use of the assets to increase the overall efficiency. Following are the important turnover ratios usually calculated by a concern.

(i) Sales to Capital Employed (or Capital Turnover) Ratio:

This ratio shows the efficiency of capital employed in the business by computing how many times capital employed is turned-over in a stated period. The ratio is ascertained as follows:

The higher the ratio, the greater are the profits. A low capital turnover ratio should be taken to mean that sufficient sales are not being made and profits are lower.

(ii) Sales to Fixed Assets (or Fixed Assets Turnover) Ratio:

This ratio measures the efficiency of the assets use. The efficient use of assets will generate greater sales per rupee invested in all the assets of a concern. The inefficient use of the asset will result in low sales volume coupled with higher overhead charges and under utilisation of the available capacity.

Hence the management must strive for using total resources at optimum level, to achieve higher RIO. This ratio expresses the number of times fixed assets are being turned-over in a stated period.

It is calculated as under:

This ratio shows how well the fixed assets are being used to generate sales in the business. The ratio is important in case of manufacturing concerns because sales are produced not only by use of current assets but also by amount invested in fixed assets. The higher is the ratio, the better is the performance. On the other hand, a low ratio indicates that fixed assets are not being efficiently utilized.

(iii) Sales to Working Capital (or Working Capital Turnover) Ratio:

This ratio shows the number of times working capital is turned-over in a stated period.

It is calculated as follows:

The higher is the ratio, the lower is the investment in working capital and the greater are the profits. However, a very high turnover of working capital is a sign of overtrading and may put the concern into financial difficulties. On the other hand, a low working capital turnover ratio indicates that working capital is not efficiently utilized.

(iv) Total Assets Turnover Ratio:

This ratio is calculated by dividing the net sales by the value of total assets (i.e. Net Sales ÷ Total Assets). A high ratio is an indicator of over-trading of total assets while a low ratio reveals idle capacity. The traditional standard for the ratio is two times.

(v) Stock Turnover Ratio:

It denotes the speed at which the inventory will be converted into sales, thereby contributing for the profits of the concern. When all other factors remain constant, greater the turnover of inventory more will be efficiency of its management.

Further, it will be higher when sales are maximum and the average inventory is minimum. This ratio establishes relationship between cost of goods sold during a given period and the average amount of inventory held during that period.

This ratio reveals the number of times finished stock is turned over during a given accounting period. Higher the ratio, the better it is because it shows that finished stock is rapidly turned-over. On the other hand, a low stock turnover ratio is not desirable because it reveals the accumulation of obsolete stock, or the carrying of too much stock.

This ratio is calculated as follows:

Where,

Cost of Goods Sold = Opening Stock + Purchases + Manufacturing Expenses − Closing Stock or Sales − Gross profit.

Suppose the cost of goods sold is Rs.4,50,000 and average stock is Rs.1,50,000. Then stock turnover ratio will be 3 times i.e., 4,50,000 ÷ Rs 1,50,000).

(vi) Receivable (or Debtors) Turnover Ratio:

It indicates the number of times on the average the receivable is turn over in each year. The higher the value of ratio, the more is the efficient management of debtors. It measures the accounts receivables (trade debtors and bills receivables) in terms of number of days of credit sales during a particular period.

It is calculated as follows:

This ratio is a measure of the collectability of accounts receivables and tells about how the credit policy of the company is being enforced. Suppose, a company allows 30 days credit to its customers and the ratio is 45; it is a cause of anxiety to the management because debts are outstanding for a period of 45 days.

Efforts should be made to make the collection machinery efficient so that the amount due from debtors may be realized in time.

Higher the ratio, more the chances of bad debts and lower the ratio, less the chances of bad debts. Suppose in 2000 Debtors in the beginning Rs 40,000; Debtors at the end Rs.50,000; Credit sales during the year Rs 2,25,000. The debtors’ turnover ratio will be calculated as under:

(vii) Creditors (or Accounts Payable) Turnover Ratio:

This ratio gives the average credit period enjoyed from the creditors and is calculated as under:

For example, if credit purchases during 1996 are Rs.2,00,000 and accounts payable on 1-1-2000 and 31-12-2000 are Rs.46,000 and Rs.34,000 respectively, then creditor’s turnover ratio will be 5 times

[i.e., Rs.2,00,000 ÷ ½ (Rs.46,000 + Rs.34,000),

A high ratio indicates that creditors are not paid in time while a low ratio gives an idea that the business is not taking full advantages of credit period allowed by the creditors.

Sometimes it is also required to calculate the average payment period (or average age of payables or debt period enjoyed) to indicate the speed with which payments for credit purchases are made to creditors. It is calculated as

Continuing the example already given, the average period of payables will be 73 days (i.e., 365 days ÷ 5).

Ratio Analysis: Type # 4. Financial Ratios:

These ratios are calculated to judge the financial position of the concern from long-term as well as short-term solvency point of view. These ratios can be divided into two broad categories:

(A) Liquidity Ratios

(B) Stability Ratios.

(A) Liquidity Ratios:

These ratios are used to measure the firm’s ability to meet short term obligations. They compare short term obligations to short term (or current) resources available to meet these obligations. From these ratios, much insight can be obtained into the present cash solvency of the firm and the firm’s ability to remain solvent in the event of adversity.

The important liquidity ratios are:

(i) Current Ratio (or Working Capital Ratio):

This is the most widely used ratio. It is the ratio of current assets to current liabilities. It shows a firm’s ability to cover its current liabilities with its current assets. It is expressed as follows:

Generally 2 : 1 is considered ideal for a concern i.e., current assets should be twice of the current liabilities. If the current assets are two times of the current liabilities, there will be no adverse effect on business operations when the payment of current liabilities is made.

If the ratio is less than 2, difficulty may be experienced in the payment of current liabilities and day-to-day operations of the business may suffer. If the ratio is higher than 2, it is very comfortable for the creditors but, for the concern, it is indicator of idle funds and a lack of enthusiasm for work.

‘Is it possible for a firm to have high current ratio and still find difficulties in paying its current liabilities’? High current ratio, i.e., the ratio of current assets to current liabilities may not necessarily indicate liquidity and be an encouraging signal from the viewpoint of short-term creditors.

All current assets cannot be treated as investments which are easily marketable and sold in case cash is required. For this purpose, the liquid ratio (discussed below) is worked out.

(ii) Liquid (or Acid Test or Quick) Ratio:

This is the ratio of liquid assets to liquid liabilities. It shows a firm’s ability to meet current liabilities with its most liquid (quick) assets. 1 : 1 ratio is considered ideal ratio for a concern because it is wise to keep the liquid assets at least equal to the liquid liabilities at all times.

Liquid assets are those assets which are readily converted into cash and will include cash balances, bills receivable, sundry debtors and short-term investments. Inventories and prepaid expenses are not included in liquid assets because the emphasis is on the ready availability of cash in case of liquid assets.

Liquid liabilities include all items of current liabilities except bank overdraft. This ratio is the ‘acid test’ of a concern’s financial soundness.

(iii) Absolute Liquidity (or Super Quick) Ratio:

Though receivables are generally more liquid than inventories, there may be debts having doubt regarding their real stability in time. So, to get idea about the absolute liquidity of a concern, both receivables and inventories are excluded from current assets and only absolute liquid assets, such as cash in hand, cash at bank and readily realizable securities are taken into consideration.

Absolute liquidity ratio is calculated as follows:

The desirable norm for this ratio is 1 : 2, i.e., Rs.1 worth of absolute liquid assets are sufficient for Rs.2 worth of current liabilities. Even though the ratio gives a more meaningful measure of liquidity, it is not in much use because the idea of keeping a large cash balance or near cash items has long since teen disproved. Cash balance yields no return and as such is barren.

(iv) Ratio of Inventory to Working Capital:

In order to ascertain that there is no overstocking, the ratio of inventory to working capital should be calculated.

It is worked out as follows:

Working Capital is the excess of current assets over current liabilities. Increase in volume of sales requires increase in size of inventory, but from a sound financial point of view, inventory should not exceed amount of working capital. The desirable ratio is 1 : 1.

(B) Stability Ratios:

These ratios help in ascertaining the long term solvency of a firm which depends on firm’s adequate resources to meet its long term funds requirements, appropriate debt equity mix to raise long term funds and earnings to pay interest and installment of long term loans in time (i.e., coverage ratios).

Following ratios can he calculated for this purpose:

(i) Fixed Assets Ratio:

This ratio explains whether the firm has raised adequate long term funds to meet its fixed assets requirements and is calculated as under:

This ratio gives an idea as to what part of the capital employed has been used in purchasing the fixed assets for the concern. If the ratio is less than one it is good for the concern. The ideal ratio is .67.

(ii) Ratio of Current Assets to Fixed Assets:

This ratio is worked out as:

This ratio will differ from industry to industry and, therefore, no standard can be laid down. A decrease in the ratio may mean that trading is slack or more mechanisation has been put through. An increase in the ratio may reveal that inventories and debtors have unduly increased or fixed assets have been intensively used. An increase in the ratio, accompanied by increase in profit, indicates the business is expanding.

(iii) Debt Equity Ratio:

It measures the extent of equity covering the debt. This ratio is calculated to measure the relative proportions of outsiders’ funds and shareholders’ funds invested in the company. This ratio is determined to ascertain the soundness of long term financial policies of that company and is also known as external-internal equity ratio.

It is calculated as follows:

Or

Shareholders’ funds consist of preference share capital, equity share capital, Profit & Loss A/c (Cr. Balance), capital reserves, revenue reserves and reserves representing marked surplus, like reserves for contingencies, sinking funds for renewal of fixed assets or redemption of debentures etc. less fictitious assets.

Whether a given debt to equity ratio shows a favourable or unfavorable financial position of the concern depends on the industry and the pattern of earning. A low ratio is generally viewed as favourable from long-term creditors’ point of view, because a large margin of protection provides safety for the creditors.

The same low ratio may be taken as quite unsatisfactory by the shareholders because they find neglected opportunity for using low-cost outsiders’ funds to acquire fixed assets that could earn a high return. Keeping in view the interest of both (shareholders and long-term creditors), debt to equity ratio of 2: 1 in case of (i) and 2: 3 in case of (ii) is acceptable.

(iv) Proprietary Ratio:

A variant of debt to equity ratio is the proprietary ratio which shows the relationship between shareholders’ funds and total tangible assets.

This ratio is worked out as follows:

This ratio should be 1: 3 i.e., one-third of the assets minus current liabilities should be acquired by shareholders’ funds and the other two-thirds of the assets should be financed by outsiders funds. It focuses the attention on the general financial strength of the business enterprise.

Ratio Analysis: Type # 5. Control Ratios:

Following control ratios are used by the management to know whether the deviations of the actual performance from the budgeted performance are favourable or unfavorable. If the ratio is 100% or more the performance is considered as favourable and if the ratio is less than 100% the performance is considered as unsatisfactory.

This ratio indicates the extent to which budgeted hours of activity is actually utilized. If the ratio is 85%, budgeted capacity is utilized up-to 85% and 15% capacity remains unutilized.

This ratio measures the level of activity attained during the budget period.

The ratio is an indicator of the efficiency attained in production over a period. Efficiency has gone up by 25% if this ratio is 125%.

This ratio indicates whether all the budgeted working days in a budget period have been available in actual practice. If the ratio is more than 100% more days have been available in actual practice and vice versa if the ratio is less than 100%.

Illustration 1:

The standard ratios for the industry and the ratios of company X are given. Indicate the strength and weaknesses as shown by your analysis

Solution:

i. Current Ratio:

It indicates better position as current assets are comparatively higher than current liabilities of a similar industry. However, the current assets may be proportionately higher due to excessive stock as had been reflected in ratio (3).

ii. Debtors Turnover Ratio:

It indicates that industry in general allows 1.5 (12 ÷ 8) months credit to customers but company X allows 1.2 (12 ÷ 10) months credit to customers. This indicates marginally controlled credit facilities. This shows effective credit policy and collection policy though there is a scope for development of potential customers with further review of credit policy.

iii. Stock Turnover Ratio:

It indicates that stock is alarmingly high as the industry’s norm is 1.22 months (12 ÷ 9.8) sales as against 3.6 months (12 ÷3.33) sales of company X. This has not been properly reflected in current ratio as the current liabilities might have been also equally high. But positively the stock is abnormally high.

iv. Assets Turnover Ratio:

It indicates that assets are comparatively higher to its turnover indicating overstocking or under-utilisation of fixed assets. This ratio further indicates overstocking.

v. Net Profit Ratio :

It is lower as compared to standard ratio. This indicates higher cost of production and less earnings before interest and tax. This requires either increase in sales realization or reduction in the cost of manufacture to ensure a reasonable return on investment.

vi. Net-Profit/Total Assets Ratio:

It indicates that total assets are disproportionately higher; partially due to overstocking of material, as indicated in (4) above. Measures are to be taken to increase the operational efficiency and reduce cost.

vii. Net Profit/Net Worth Ratio:

It indicates that the capital structure of the X Company is having very low Debt/Equity ratio. The earning capacity and earnings per share is also very low.

viii. Total Debts/Total Assets Ratio:

It is lower for X company which indicates low capital gearing. The total assets are substantially high leading to this ratio lower than the standard even though the current ratio is high.

On the above basis it can be said that stock is very high though there is good control over debtors and credit control policy. There is need for increasing the operational efficiency of production. Debts can be increased.

The company is over capitalized due to high stock and fixed assets. The company should make attempt to reduce operating expenses to increase the net profit ratio. The company’s performance is not satisfactory as compared to standard of the industry and there exists scope for improvement.

Illustration 2:

Make an assessment of the comparative positions of firms A, B and C after calculating relevant ratios on the oasis of the following information for a year having assuming 360 days in a year.

Solution:

From the above we see the inventory turnover of firm A is better than of B and C. Firm C has the lowest ratio, i.e., it has the slowest moving stock.

The average number of days credit allowed to customers is 72 days in firm A and 144 days in firms C, which is just the double of A. It indicates that firm A is following a sound credit policy whereas firm B and C are following a liberal policy. It is possible that firm B and C may have given credit to weak customers and they are not making the payment in time.

Inventory turnover ratio and average collection period indicate that firm A is making an efficient use of its working capital as compared to firm B and C. C’s position in this regard is the weakest.

Calculation of the amount of Net Profit

Firm A is earning a profit of Rs.1,00,000 in spite of the low percentage of gross profit. This is because of less expenses of management. On the other hand, C is suffering a loss of Rs.40,000 in spite of the highest percentage of gross profit.

This is because of the highest figure of management expenses. Firm B and C should try to curtail the expenses of management and increase the inventory turnover ratio to make an improvement in their performance.

To conclude, performance of firm A is better than the performances of firms B and C.

Illustration 3:

Prepare Profit & Loss A/c and Balance Sheet from the following information:

Capital Rs.4,00,000; Working Capital Rs.1,80,000; Bank Overdraft Rs.30,000. There are no fictitious assets. Current assets contain only stock, debtors and cash.

Following additional data is also available:

Solution: