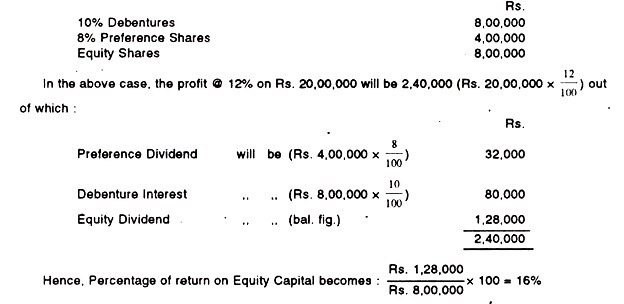

In this article we will discuss about the accounting provisions regarding un-realised profits in the consolidated balance sheet, explained with the help of illustrations.

Un-realised profits may occur when there are inter-company purchases and sales. The problem of un-realised profits arises in those cases where companies of the same group have sold goods to each other at a profit and the goods still remain unsold with the company to whom the goods were sold. In such cases, it is not proper to credit the profit and loss account with such un-realised profits.

Such inter-company un-realised profits mush be eliminated and due adjustments effected in the stock, lying with the purchasing company, so that it could be shown at cost in the consolidated Balance Sheet. Where the subsidiaries are partly owned and goods are supplied by them at profits, only the holding company’s proportion of such profits is eliminated. The reason is that from the point of the minority shareholders the profit has been realised.

Consider that holding company’s stock of Rs 2, 00,000 included Rs 50,000 goods supplied by its subsidiary to whom they cost Rs 46,000.

ADVERTISEMENTS:

If the holding company owns 3/4 of the subsidiary’s capital, the consolidated Balance Sheet would show:

This amount of Rs 3,000 would also be eliminated from the holding company’s proportion of the subsidiary’s profit so that consolidated Profit and Loss Account is credited with the adjusted profits only.

The modern practice is to create the whole of the un-realised profit as stock reserve without adjusting the share of the minority shareholders. The stock reserve is created whether the goods are sold by the holding company to the subsidiary or vice versa, at a profit.

ADVERTISEMENTS:

The amount of un-realised profit (Stock Reserve) is deducted from the stock on the assets side and also from the Profit and Loss Account on the liability side of the consolidated Balance Sheet. Thus stock’ will be shown at its true cost and the Profit and Loss Account will show only realised profit.

Illustration 1 (Un-Realised Profits):

From the Balance Sheet and Information given below, prepare consolidated Balance Sheet: Balance Sheets as on 31st Dec. 2004

Additional information:

ADVERTISEMENTS:

(i) The Bills accepted by S Ltd. are all in favour of H Ltd.

(ii) The Stock of H Ltd. includes Rs 25,000 bought from S Ltd. at a profit to latter of 20% on sales.

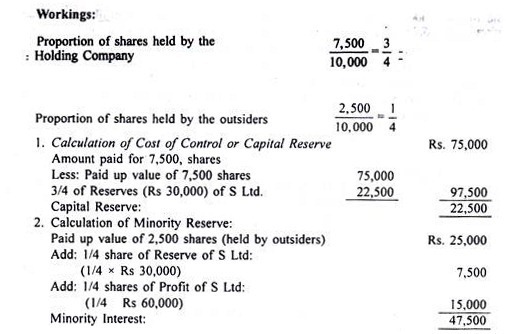

(iii) All the profit of S Ltd. has been earned since the shares were acquired by H Ltd but there was already the reserve of Rs. 30,000 at that date.

Illustration 2 (Cash-In-Transit & Mutual Obligation):

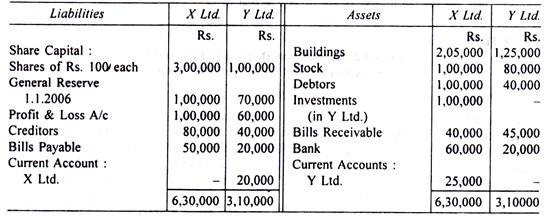

X Ltd. purchased 750 shares in Y Ltd. on 1.7.2006. The following were their Balance Sheets on 31.12.2006.

ADVERTISEMENTS:

Further:

1. Bills Receivable of X Ltd. include Rs. 10,000 accepted by Y Ltd.

ADVERTISEMENTS:

2. Debtors of X Ltd. include Rs. 20,000 payable by Y Ltd.

3. A cheque of Rs. 5,000 sent by Y Ltd. on 20th December was not yet received by X Ltd. till 31st December 2006.

4. Profit and Loss Account of Y Ltd. showed a balance of Rs. 20,000 on 1st January 2006.

ADVERTISEMENTS:

You are required to prepare a consolidated Balance sheet of X Ltd. and Y Ltd. as on 31st December 2006.

Illustration 3 (Un-Realised Profits):

H. Ltd. acquired 40,000 shares in S. Ltd. as at 1st Jan. 2004 at a total cost of Rs. 4, 00,000. The Balance Sheets as a 31st Dec. 2004 when account of both companies were prepared, were as under.

(a) Includes Rs. 30,000 for purchase from S Ltd. on which S. Ltd., made a profit of Rs. 7,500.

ADVERTISEMENTS:

(b) Includes Rs. 15,000 Stock at cost purchased from S Ltd. part of Rs. 30,000 purchase [see not (a)]

(c) Includes Interim Dividend @ 16% p.a. free of tax, from S Ltd.