After reading this article you will learn about the shareholding pattern of reliance industries in India.

A public company is usually characterised by a large body of equity shareholders. You should be aware of that equity shareholders are the provider of capital to the company and bear the business risk just like the owner(s) of a sole proprietorship or partnership business. They are not entitled to any fixed return. In case the company is closed, they will get whatever residual value is left out of selling all assets and repayment of dues to all other claimants. So the equity shareholders are called to have residual interest in the company.

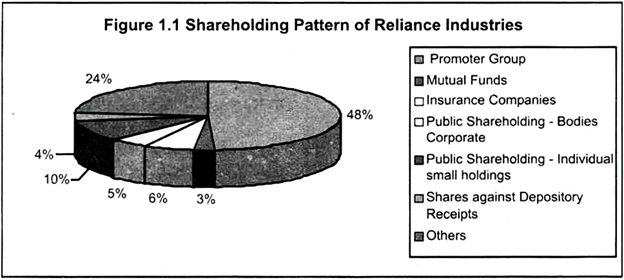

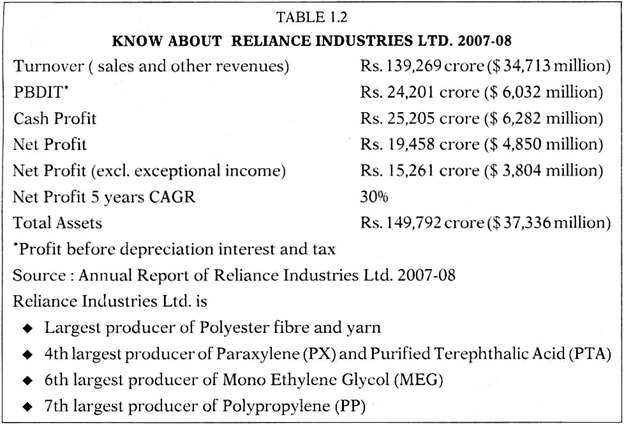

Equity shareholders are owners of the company, and the capital they provide is termed as equity share capital. In a company there can be many different classes of equity shares having different types of voting right. If a company has only one class of equity, all equity shareholders belonging to that class shall have proportionate voting right in accordance with their shareholding. Normally, one share may have one vote. Refer to Table 1.1 and Figure 1.1 to know about shareholding pattern of Reliance Industries Ltd., a leading Indian company.

How is a company managed? How can a large body of equity shareholders manage a company? In fact, the shareholders appoint a management board which is called Board of Directors. You must appreciate that a group of shareholders must have taken initiative initially to form a company, which is a legal entity established by the company law of a country – they are called promoters.

ADVERTISEMENTS:

Normally, the shareholders elect the board of directors through preferential voting. By this all section of the shareholders get their representation in the Board of Directors. The Board is not elected by majority shareholding group only. Refer to Table 1.3 to know about the composition of Board of Directors of Reliance Industries Ltd.

As on 31-3-2009. Used only as an academic exercise.

The Board of Directors run a company as trustee of all shareholders and in modern viewpoint on behalf of all stakeholders. The Board has the overall responsibility of preparation and presentation of financial statements of a company.