Are you looking for problems and solutions of final accounts of the companies? You are at the right place! In this article we have compiled top three accounting problems on final accounts of the companies with its relevant solutions.

Contents:

- Final Accounts Including the Computation of Managing Director’s Remuneration

- Preparation of Final Accounts of a Company When Additional Information is Provided

- Final Accounts Including the Preparation of Income Tax Account

Problems on Final Accounts of the Companies

1. Final Accounts Including the Computation of Managing Director’s Remuneration:

Following are the balances (rounded-off to the nearest thousand) from the books of Good Earth Ltd. as on 31.12.95:

Calculate-Managing Director’s remuneration and prepare in the proper form the Profit and Loss Account and Balance Sheet as of December 31, 1995 with the help of the following additional information:

2. Preparation of Final Accounts of a Company When Additional Information is Provided:

The following balances have been extracted from the books of Glory Limited, as on 30th September 1995:

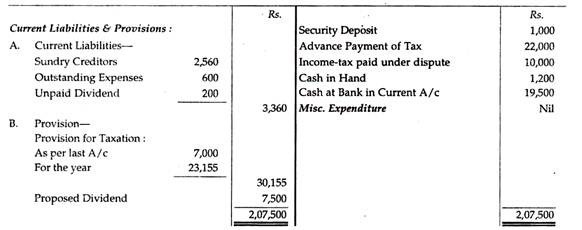

The following additional information are available:

(1) The Preference Shares were redeemed on 1.4.1995 at a premium of 20%, but no entries were passed for giving effect thereto, except payment standing to the debit of Preference Share Redemption Account.

(2) Depreciation as per Income-tax rules provided up to 30.9.1995 is as follows: Buildings Rs. 21,900; Furniture Rs. 2,000; Motor Vehicles Rs. 6,000.

ADVERTISEMENTS:

(3) Payment to Auditors includes Rs. 100 for taxation work in addition to audit fees.

(4) Market value of investment on 30.9.1995 Rs. 18,000.

(5) Interim dividend includes dividend on Equity Shares Rs. 7,500 and dividend on Preference Shares Rs. 160.

(6) Sundry debtors include Rs. 2,000 due for a period exceeding six months.

ADVERTISEMENTS:

(7) All receivables and deposits are considered good.

(8) Income-tax demand for the year ended 30.9.1994 for Rs. 10,000 has not been provided for in full against which an appeal is pending.

(9) Income-Tax to be provided at 55%.

(10) Directors have recommended payment of a further dividend on Equity Shares at 50 paise per share after appropriating Rs. 3,000 to General Reserves.

ADVERTISEMENTS:

(11) Ignore previous year’s figures.

You are required to prepare the Profit and Loss Account for the year ended 30th September 1995 and a Balance Sheet as at that date.

Note:

ADVERTISEMENTS:

Contingent liability – not provided for on account of income-tax assessment, which is under appeal— is Rs. 3,000.

ADVERTISEMENTS:

ADVERTISEMENTS:

3. Final Accounts Including the Preparation of Income Tax Account:

Following balances have been extracted from the books of Adarsh Ltd. as at 31st December, 1996:

The following additional information is also available:

(i) The authorised capital of the company is 80,000 Equity Shares of Rs. 10 each of which 50% has been issued and has been fully called-up and paid-up.

(ii) A dividend of 15% on the paid-up capital has been recommended by the Directors.

(iii) The Closing Stock of finished goods at cost is Rs. 5,60,000.

ADVERTISEMENTS:

(iv) The Development Rebate Reserve is no longer required.

(v) Depreciation on Plant and Machinery amounting to Rs. 43,000, on furniture amounting to Rs. 1,300 and on Building amounting to Rs. 3,800 has been debited to Miscellaneous Expenses.

(vi) Surplus in Profit and Loss account after proposed dividends is to be transferred to General Reserve.

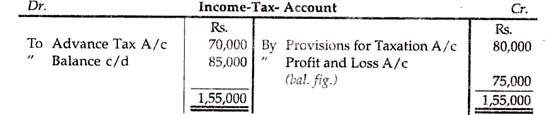

(vii) Income-tax assessment for a prior year has been completed, fixing the income-tax liability at Rs. 1,55,000 (against which a provision of Rs. 80,000 and an advance of tax of Rs. 70,000 exists in the books)

You are required to prepare:

1. Profit & Loss Account for the year ended 31st December 1996 and

2. Balance Sheet in the prescribed form as on that date.

Workings:

1. For an Indian Company the rate of tax payable for the relevant previous year is 40% along with a Surcharge of 15% i.e. 40% + (15% of 40%) 6% = 46%.

2. Tax liability for the earlier year came to Rs. 70,000 which is adjusted against advance tax paid. The balance unpaid remains a current liability which is shown in the liability side of the Balance Sheet (i.e. Rs. 1,55,000 – Rs. 70,000) Rs. 85,000.

For this purpose, it would be better for us if we open the following accounts relating to Income-Tax and Income tax liability:

3. Transfer to Reserve (Statutory):

Since the rate of proposed dividend on equity shares is 15%, a sum equal to 5% of the net profit should be transferred, i.e. Rs. 2,29,446 x 5/100 = Rs. 11,472.