Hedges of foreign currency denominated assets and liabilities, such as accounts receivable and accounts payable, can qualify as either cash flow hedges ox fair value hedges. To qualify as a cash flow hedge, the hedging instrument must completely offset the variability in the cash flows associated with the foreign currency receivable or payable. If the hedging-instrument does not qualify as a cash flow hedge or if the company elects not to designate the hedging instrument as a cash flow hedge, the hedge is designated as a fair value hedge.

The following summarizes the basic accounting for the two types of hedges:

I. Cash Flow Hedge:

At each balance sheet date, the following procedures are required:

1. The hedged asset or liability is adjusted to fair value based on changes in the spot exchange rate, and a foreign exchange gain or loss is recognized in net income.

ADVERTISEMENTS:

2. The derivative hedging instrument is adjusted to fair value (resulting in an asset or liability reported on the balance sheet) with the counterpart recognized as a change in Accumulated Other Comprehensive Income (AOCI).

3. An amount equal to the foreign exchange gain or loss on the hedged asset or liability is then transferred from AOCI to net income; the net effect is to offset any gain or loss on the hedged asset or liability.

4. An additional amount is removed from AOCI and recognized in net income to reflect- (a) the current period’s amortization of the original discount or premium on the forward contract (if a forward contract is the hedging instrument) or (b) the change in the time value of the option (if an option is the hedging instrument).

II. Fair Value Hedge:

At each balance sheet date, the following procedures are required:

ADVERTISEMENTS:

1. Adjust the hedged asset or liability to fair value based on changes in the spot exchange rate and recognize a foreign exchange gain or loss in net income.

2. Adjust the derivative hedging instrument to fair value (resulting in an asset or liability reported on the balance sheet) and recognize the counterpart as a gain or loss in net income.

Forward Contract used to Hedge a Foreign Currency Denominated Asset:

We now return to the Amerco example in which the company has a foreign currency account receivable to demonstrate the accounting for a hedge of a recognized foreign currency denominated asset. In the preceding example, Amerco has an asset exposure in euros when it sells goods to the German customer and allows the customer three months to pay for its purchase. To hedge its exposure to a decline in the U.S. dollar value of the euro, Amerco enters into a forward contract.

Assume that on December 1, 2009, the three-month forward rate for euros is $1.305 and Amerco signs a contract with New Manhattan Bank to deliver 1 million euros in three months in exchange for $1,305,000. No cash changes hands on December 1, 2009. Because the spot rate on December 1 is $1.32, the euro (€) is selling at a discount in the three-month forward market (the forward rate is less than the spot rate). Because the euro is selling at a discount of $0.015 per euro, Amerco receives $ 15,000 less than it would had payment been received at the date the goods are delivered ($1,305,000 versus $1,320,000).

ADVERTISEMENTS:

This $15,000 reduction in cash flow can be considered as an expense; it is the cost of extending foreign currency credit to the foreign customer. Conceptually, this expense is similar to the transaction loss that arises on the export sale. It exists only because the transaction is denominated in a foreign currency.

The major difference is that Amerco knows the exact amount of the discount expense at the date of sale, whereas when it is left unhedged, Amerco does not know the size of the transaction loss until three months pass. (In fact, it is possible that the unhedged receivable could result in a transaction gain rather than a transaction loss.)

Because the future spot rate turns out to be only $1.30, selling euros at a forward rate of $1.305 is obviously better than leaving the euro receivable unhedged: Amerco will receive $5,000more as a result of the hedge. This can be viewed as a gain resulting from the use of the forward contract. Unlike the discount expense, the exact size of this gain is not known until three months pass. (In fact, it is possible that use of the forward contract could result in an additional loss. This would occur if the spot rate on March 1, 2010, is more than the forward rate of $1.305.)

Amerco must account for its foreign currency transaction and the related forward contract simultaneously but separately. The process can be better understood by referring to the steps involving the three parties—Amerco, the German customer, and New Manhattan Bank— shown in Exhibit 9.2.

Because the settlement date, currency type, and currency amount of the forward contract match the corresponding terms of the account receivable, the hedge is expected to be highly effective. If Amerco properly designates the forward contract as a hedge of its euro account receivable position, it may apply hedge accounting.

Because it completely offsets the variability in the cash flows related to the account receivable, Amerco may designate the forward contract as a cash flow hedge. Alternatively, because changes in the spot rate affect not only the cash flows but also the fair value of the foreign currency receivable, Amerco may elect to account for this forward contract as a fair value hedge.

In either case, Amerco determines the fair value of the forward contract by referring to the change in the forward rate for a contract maturing on March 1, 2010.

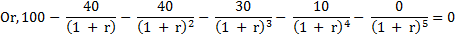

The relevant exchange rates, U.S. dollar value of the euro receivable, and fair value of the forward contract are determined as follows:

Amerco pays nothing to enter into the forward contract at December 1, 2009, and the forward contract has a fair value of zero on that date. At December 31, 2009, the forward rate for a contract to deliver euros on March 1, 2010, is $1,316. Amerco could enter into a forward contract on December 31, 2009, to sell 1 million euros for $1,316,000 on March 1, 2010. Because Amerco is committed to sell 1 million euros for $1,305,000, the nominal value of the forward contract is $(11,000).

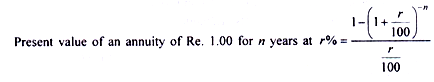

The fair value of the forward contract is the present value of this amount. Assuming that Amerco has an incremental borrowing rate of 12 percent per year (1 percent per month) and discounting for two months (from December 31, 2009, to March 1, 2010), the fair value of the forward contract at December 31,2009, is $(10,783), a liability. On March 1, 2010, the forward rate to sell euros on that date is the spot rate, $1.30.

At that rate, Amerco could sell 1 million euros for $1,300,000. Because Amerco has a contract to sell euros for $1,305,000, the fair value of the forward contract on March 1, 2010, is $5,000. This represents an increase of $15,783 in fair value from December 31, 2009. The original discount on the forward contract is determined by the difference in the euro spot rate and three-month forward rate on December 1, 2009: ($1,305 – $1.32) × € 1 million = $15,000.

Forward Contract Designated as Cash Flow Hedge:

Assume that Amerco designates the forward contract as a cash flow hedge of a foreign currency denominated asset. In this case, it allocates the original forward discount or premium to net income over the life of the forward contract using an effective interest method.

ADVERTISEMENTS:

The company prepares the following journal entries to account for the foreign currency transaction and the related forward contract:

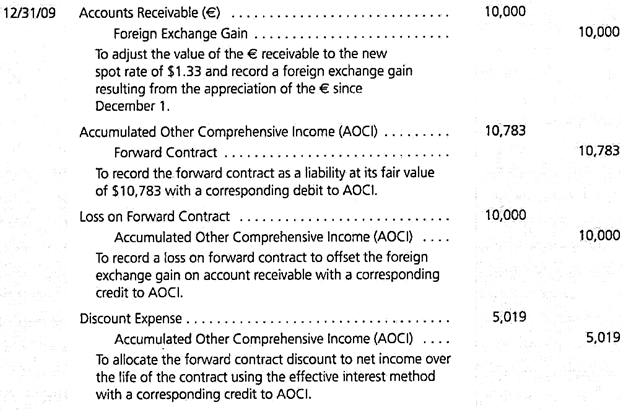

2009 Journal Entries—Forward Contract Designated as a Cash Flow Hedge:

Amerco makes no formal entry for the forward contract because it is an executory contract (no cash changes hands) and has a fair value of zero (Step 2 in Exhibit 9.2).

Amerco prepares a memorandum designating the forward contract as a hedge of the risk of changes in the cash flow to be received on the foreign currency account receivable resulting from changes in the U.S. dollar-euro exchange rate.

The first entry at December 31, 2009, serves to revalue the foreign currency account receivable and recognize a foreign exchange gain of $10,000 in net income as required by SFAS 52. The second entry recognizes the forward contract as a liability of $10,783 on the balance sheet in accordance with SFAS 133. Because the forward contract has been designated as a cash flow hedge, the debit of $10,783 in the second entry is made to AOCI, which decreases stockholders’ equity. The third entry achieves the objective of hedge accounting by transferring $10,000 from AOCI to a loss on forward contract.

As a result of this entry, the loss on forward contract of $10,000 and the foreign exchange gain on the account receivable of $10,000 exactly offset one another, and the net impact on income is zero. As a result of the second and third entries, the forward contract is reported on the balance sheet as a liability at fair value of $(10,783); a loss on forward contract is recognized in the amount of $10,000 to offset the foreign exchange gain; and AOCI has a negative (debit) balance of $783.

The second and third entries could be combined into one entry as follows:

The negative balance in AOCI of $783 can be viewed as that portion of the loss on the forward contract (decrease in fair value of the forward contract) that is not recognized in net income but instead is deferred in stockholders’ equity. Under cash flow hedge accounting, a loss on the hedging instrument (forward contract) is recognized only to the extent that it offsets a gain on the item being hedged (account receivable).

The net effect on the balance sheet over the two years is a $1,305,000 increase in cash with a corresponding increase in Retained Earnings of $1,305,000 ($1,314,981 – $9,981). The cumulative amount recognized as Discount Expense of $15,000 reflects the cost of extending credit to the German customer.

The net benefit from entering into the forward contract is $5,000. This “gain” is reflected in net income as the difference between the net gain on the forward contract and the cumulative amount of discount expense ($20,000 – $15,000 = $5,000) recognized over the two periods.

Effective Interest versus Straight-Line Methods:

Use of the effective interest method results in allocating the forward contract discount $5,019 at the end of the first month and $9,981 at the end of the next two months.

Straight-line allocation of the $15,000 discount on a monthly basis results in a reasonable approximation of these amounts:

Determining the effective interest rate is complex and provides no conceptual insights. We use straight-line allocation of forward contract discounts and premiums, as is allowed by the FASB’s Derivatives Implementation Group. The important thing to keep in mind in this example is that with a cash flow hedge, an expense equal to the original forward contract discount is recognized in net income over the life of the contract.

What if the forward rate on December 1, 2009, had been $1,326 (i.e., the euro was selling at a premium in the forward market)? In that case, Amerco would receive $6,000 more through the forward sale of euros ($1,326,000) than had it received the euros at the date of sale ($1,320,000). Amerco allocates the forward contract premium as an increase in net income at the rate of $2,000 per month- $2,000 at December 31, 2009, and $4,000 at March 1, 2010.

Forward Contract Designated as Fair Value Hedge:

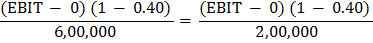

Assume that Amerco decides to designate the forward contract not as a cash flow hedge but as a fair value hedge. In that case, it takes the gain or loss on the forward contract directly to net income and does not separately amortize the original discount on the forward contract.

The first entry at December 31, 2009, serves to revalue the foreign currency account receivable and recognize a foreign exchange gain of $10,000 as required by SFAS 52. The second entry recognizes the forward contract as a liability of $ 10,783 on the balance sheet in accordance with SFAS 133.

Because the forward contract has been designated as a fair value hedge, the debit in the second entry recognizes the entire change in fair value of the forward contract as a loss in net income; there is no deferral of loss in stockholders’ equity. A net loss of $783 is reported in net income as a result of these two entries.

The impact on net income for the year 2009 is as follows:

The net effect on the balance sheet for the two periods is an increase of $1,305,000 in Cash with a corresponding increase in Retained Earnings of $1,305,000 ($1,319,217 — $14,217).

Under fair value hedge accounting, the company does not amortize the original forward contract discount systematically over the life of the contract. Instead, it recognizes the discount in income as the difference between the foreign exchange Gain (Loss) on the account receivable and the Gain (Loss) on the forward contract—that is, $(783) in 2008 and $(14,217) in 2009.

The net impact on net income over the two years is $(15,000), which reflects the cost of extending credit to the German customer. The net gain on the forward contract of $5,000 ($10,783 loss in 2009 and $15,783 gain in 2010) reflects the net benefit (i.e., increase in cash inflow) from Amerco’s decision to hedge the euro receivable.

Companies often cannot or do not bother to designate as hedges the forward contracts they use to hedge foreign currency denominated assets and liabilities. In those cases, the company accounts for the forward contract in exactly the same way it would if it had designated it as a fair value hedge. The company reports an undesignated forward contract on the balance sheet at fair value as an asset or liability and immediately recognizes changes in the fair value of the forward contract in income.

The only difference between a forward contract designated as a fair value hedge of a foreign currency denominated asset or liability and an undesignated forward contract is the manner in which the company discloses it in the notes to the financial statements. E.I. du Pont de Nemours and Company provided the following disclosure related to this in its 2005 Form 10-K.

Derivatives not Designated in Hedging Relationships:

The company uses forward exchange contracts to reduce its net exposure, by currency, related to foreign currency-denominated monetary assets and liabilities. The netting of such exposures precludes the use of hedge accounting. However, the required revaluation of the forward contract and the associated foreign currency-denominated monetary assets and liabilities results in a minimal earnings impact, after taxes.

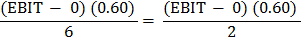

Cash Flow Hedge versus Fair Value Hedge:

A forward contract used to hedge a foreign currency denominated asset or liability can be designated as either a cash flow hedge or a fair value hedge when it completely offsets the variability in cash flows associated with the hedged item. The total impact on income is the same regardless of whether the forward contract is designated as a fair value hedge or as a cash flow hedge. In our example, Amerco recognized an expense (or loss) of $15,000 in both cases, and the company knew what the total expense was going to be as soon as the contract was signed.

A benefit to designating a forward contract as a cash flow hedge is that the company knows the forward contract’s effect on net income each year as soon as the contract is signed. The net impact on income is the periodic amortization of the forward contract discount or premium. In our example, Amerco knew on December 1, 2009, that it would recognize a discount expense of $5,000 in 2009 and $10,000 in 2010. The impact on each year’s income is not as systematic when the forward contract is designated as a fair value hedge—loss of $783 in 2009 and $14,217 in 2010.

Moreover, the company does not know what the net impact on 2009 income will be until December 31, 2009, when the euro account receivable and the forward contract are revalued. Because of the potential for greater volatility in periodic net income that results from a fair value hedge, companies may prefer to designate forward contracts used to hedge a foreign currency denominated asset or liability as cash flow hedges.