Are you looking for problems and solutions on liquidation of companies? You are in the right place! In this article we have compiled six selected accounting problems on liquidation of companies with its relevant solutions.

Contents:

- Preparation of Liquidator’s Statement of Account

- Preparation of Liquidator’s Cash Account and Liquidator’s Final Statement of Account

- Preparation of Statement of Affairs and Deficiency Account by the Director. Also Showing Preparation of Liquidator’s Final Statement of Accounts by the Liquidator

- Preparation of Liquidator’s Final Statement of Account in the Order of Payments

- Preparation of Statement of Liability

Problems on Liquidation of Companies

1. Preparation of Liquidator’s Statement of Account:

You are asked by a liquidator of a company to prepare a statement of account to be laid before a meeting of the shareholders from the following:

The assets realised as follows: 1.4.1994 : Fixed Assets Rs. 1,00,000; Book Debts Rs. 1,00,000, Expenses paid Rs. 4,000. 1.6.1994 : Fixed Assets (final) Rs. 2,00,000, Book Debts Rs. 1,00,000. 1.8.1994 : Book Debts (final payment) Rs. 50,000. The liquidator is entitled to 5% on collections and 2% on the account paid to Equity shareholders.

Prepare the statement on the assumption that disbursements are made in accordance with law, as and when cash is available.

Solution:

2. Preparation of Liquidator’s Cash Account and Liquidator’s Final Statement of Account:

The following is the position as on 31.12.1993 of X. Ltd., which goes into voluntary liquidation as on that date:

The following information is given:

(a) The loan from State Financial Corporation is secured by first charge on Fixed Assets.

ADVERTISEMENTS:

(b) The Bank is secured by pledge of gold, hypothecation of all Current Assets and a second charge on Fixed Assets.

(c) Creditors include Preferential Creditors of Rs. 2,00,000. On 15.1.1994, Stocks are sold. Stock in pledge/godown realised Rs. 14,00,000 and other stocks were sold for Rs. 4,00,000. On 31.1.1994, expenses of liquidation amounting to Rs. 3,000 are met and Fixed Assets are sold for Rs. 13,00,000. On 15.2.1994, all other Current Assets realised for Rs. 19,10,000 and liquidator’s remuneration amounting to Rs. 7,000 are paid.

Prepare Liquidator’s Cash Account and Liquidator’s Final Statement of Account presuming that all payments are made in order of preference on earliest availability of Cash.

3. Preparation of Statement of Affairs and Deficiency Account by the Director. Also Showing Preparation of Liquidator’s Final Statement of Accounts by the Liquidator:

O.P. Ltd. resolved to wind-up as on 31.12.1999 as members’ voluntary winding up.

ADVERTISEMENTS:

The Trial Balance as on that date was:

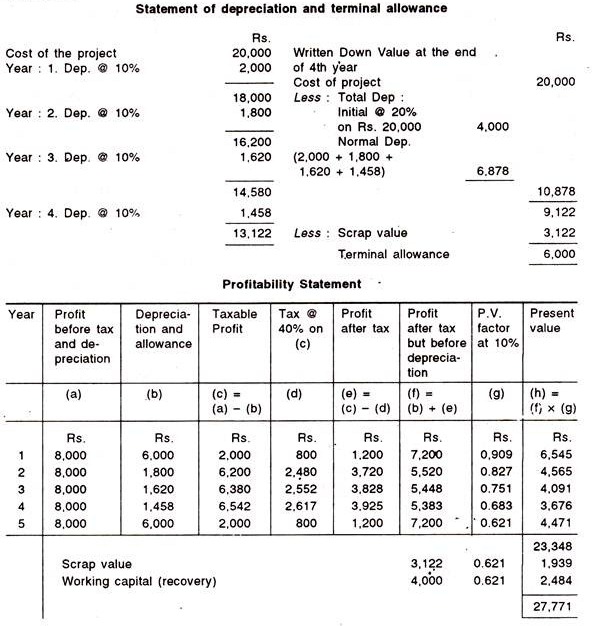

On 1.1.2000, the liquidator sold some of the assets to O.P. Ltd. (2000) for the following valuations:

ADVERTISEMENTS:

Plant Rs. 90,000; Goodwill Rs. 25,000; Stock Rs. 40,000. The purchase consideration was satisfied by 8% Debentures of Rs. 75,000 issued at 4% Discount and the balance in Cash.

Preference shareholders are to be paid dividend up to the date of commencement of liquidation and 5% premium before anything is paid to equity shareholders.

Debtors realised Rs. 40,000 gross, collection expenses being Rs. 500. Six month’s Debenture interest was received from OP Ltd. (2000) on 30.6.2000. The creditors were discharged subject to 5% discount. Liquidation expenses amounted to Rs. 800 and liquidator’s remuneration was paid Rs. 4,000.

Preference shareholders were paid in cash with premium and dividend. The debentures and cash balance were paid to the equity shareholders.

ADVERTISEMENTS:

Prepare:

(a) Statement of Affairs as on 31.12.1999 on the basis of facts known as on that date and the agreement with OP Ltd. (2000);

(b) Deficiency Account up to 31.12.1999; and

(c) Liquidator’s Statement of Account.

ADVERTISEMENTS:

The statutory forms need not be followed.

Solution:

In this case, Statement of Affairs and Deficiency Account will be prepared by the Directors as the terms between OP (2000) and the preference shareholders are known at the commencement of liquidation. But Liquidator’s Final Statement of Accounts will be prepared by the liquidator.

Notes:

ADVERTISEMENTS:

* Total consideration amounted to Rs. 1,55,000, including Debentures amounting to Rs. 72,000 (i.e. Rs. 75,000 @ 4% discount or 75,000 – 3,000).

† Rs. 75,000 x 8/100 x 6/12 = Rs. 3,000.

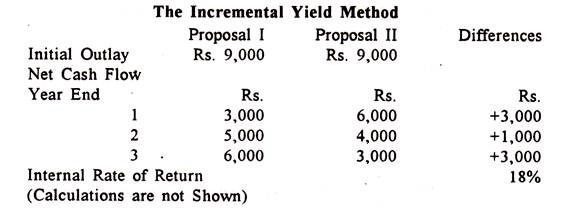

4. Preparation of Liquidator’s Final Statement of Account in the Order of Payments:

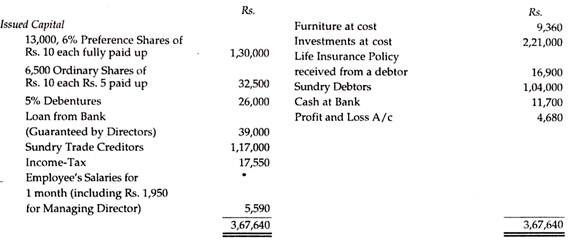

X Ltd. went into voluntary liquidation on 31st Oct. 1999.

The balances in its books on that day were:

The bank called upon the Directors to implement their guarantee. The preference dividend had been paid up to 30th June 1999. There were no arrears of debenture interest. The amount owing to the Govt. for income-tax was in respect of assessment years 1997-98, 1998-99 and 1999-2000 of Rs. 3,250, Rs. 13,650 and Rs. 650, respectively. The company closes its accounts on, 31st December each year.

All the employees of the company had already been served with a notice to quit on 31st Oct. 1999. The liquidator admitted an amount of Rs. 2,730 for salaries in lieu of notice.

The rent was paid up to 31st Oct. 1999. The premises were held under a lease with annual tenancy. The landlord agreed to waive his right to notice on the liquidator undertaking to pay him two months’ rent i.e., Rs. 650 and to vacate the premises by 31st Dec. 1999, which he did.

One of the creditors for Rs. 13,000 was under a contract to deliver certain goods to the company in Dec. 1999, and the company had contracted to supply the same goods to B. Ltd., who were included in Sundry Debtors at Rs. 6,500 The creditor refused to make delivery but admitted a claim made by the liquidator for damages at Rs. 1,625. B. Ltd. made a claim for loss against the company for Rs. 975 which was admitted by the liquidators.

Furniture was sold for Rs. 7,800. Investments were found to be valueless. Sums owing by Debtors were all collected and the Insurance Policy was surrendered for Rs. 15,600 after the liquidator had paid a premium of Rs. 585. A shareholder holding 2,600 ordinary shares failed to pay the call made by the liquidator. Legal costs came to Rs. 780 and liquidator’s remuneration was Rs. 6,500.

Prepare Liquidator’s Final Statement of Account in the order of payments.

5. Preparation of Statement of Liability:

The liquidation of P. Ltd. commenced on 1st April 1987, and the assets were insufficient to pay the creditors. Unpaid amounts could not be realised from List A contributories.

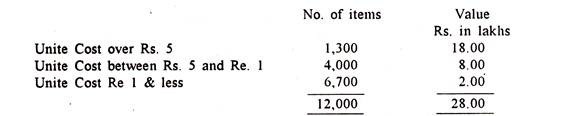

From the following particulars, prepare a statement of liability of List B contributories:

All the shares were of Rs. 10 each of which Rs. 15 paid-up.

Solution:

From the problem, it is quite clear that the amount outstanding on 1st May 1986 was Rs. 3,000 which must be contributed by the four shareholders according to the number of shares held by them, i.e., in the ratio of 10: 15: 3: 2. And, as such, Piu, Mau, Sampa and Raja will have to contribute Rs. 1,000, Rs. 1,500 Rs. 300 and Rs. 200, respectively.

At the same time, the further debts, i.e., Rs. 750 (3,750 – 3,000) which were incurred between 1st May 1986 and 1st July 1986 (for which Piu is not liable) have to be contributed by Mau, Sampa and Raja in the ratio of 15: 3: 2, respectively, i.e., Mau, Sampa and Raja will contribute Rs. 563, Rs. 112 and Rs. 75, respectively.

Similarly, the debts which increases from Rs. 3,750 to Rs. 4,000, i.e. Rs. 250 occurring between 1st July 1986 and 1st Nov. 1986, will have to be shared by Sampa and Raja in 3: 2, i.e., Rs. 150 and Rs. 100, respectively. At the same time, the debts which was incurred between 1st Nov. 1986 and 1st Feb. 1987 were solely to be borne by Raja.

On the basis of the above, the following statement is prepared:

Since Raja’s liability came to Rs. 1,125, he can be called upon to pay only Rs. 400, as such, the loss must be suffered by the creditors amounted to Rs. 725.

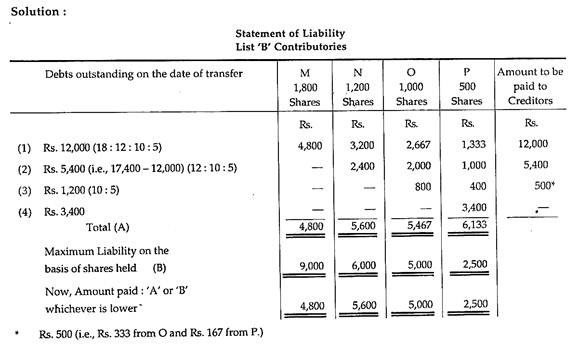

6. Preparation of Statement of Liability:

In a winding up which commenced on 15th September 1996, certain creditors could not receive payments out of the realisation of assets and out of contribution from ‘A’ list of contributories.

Following are the details of certain share transfers that took place prior to liquidation and the amount of creditors remaining unpaid:

All the shares were of Rs. 10 each, on which Rs. 5 per share had been called and paid up. expenses of liquidation, remuneration to liquidator etc., work out the amount to be realised above contributories.

Note:

A shareholder who had transferred his shares within 12 months from the date of winding up is liable to contribute as per List ‘B’. It is quite clear from the above problem that one shareholder (L) has transferred his shares more than 12 months ago, so he is not liable to contribute. The rest, i.e. 4 shareholders (M, N, O, and P), are liable to contribute accordingly.